August – Everything just got a bit more expensive

August 1st came, and while us common folks may not have felt anything, many US industries and pretty soon the consumer, will feel a pinch. This is also true for foreign companies exporting to the US as most are not able to pass on 100% of the tariffs’ cost. More on this in the chart of the month.

If you thought that we can now finally turn the page on this saga, you are wrong. There remains a lot of uncertainty on which goods might or might not be exempt, what the final tariff will be on countries that got a last-minute extension (Mexico, China). Some countries had their fate already sealed, with the most significant levies hitting Brazil (50%), Canada (35%) and Switzerland (39%). Others fared relatively well, like the UK and the European Union at 10% and 15% respectively.

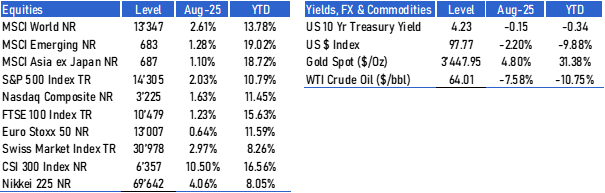

All this uncertainty didn’t stop the markets from breaking one record high after another, with emerging markets leading the pack. In the US, this is true for all sectors (ex-healthcare). While this can be easily explained by macro-economic factors that typically favor emerging economies, such as a weakening USD, central banks easing cycles, slowing US growth, it is a lot harder to explain why the eurozone is doing so well this year given the poor growth prospects combined with political and fiscal problems. Sure, pharma and defense are doing well, but a weaker USD and tariffs could come back to bite investors who got too excited about the region.

Data source : Bloomberg

United States inflation remained stable at 2.7% in July, but that is before the impact of a large chunk of the tariffs came into effect. Unemployment figures remain healthy (though weakening), and PMIs are in full expansion mode. This put the Federal Reserve in a pickle. There is not much to justify lowering interest rates at the moment, and any action resulting from pressures of the White House would be damaging to the perceived independence of the Fed.

In Europe, worries are coming out of France, French Prime Minister Bayrou having called for a vote of confidence in him. This is a double or nothing bet, in which his government either collapses or secures the approval for his unpopular budget, which is at the center of the current drama. Furthermore, the French government debt is currently at risk of a downgrade. Investors are not waiting for it to happen, as yields are currently above that of countries like Greece, Portugal, Spain (3 of the countries formerly known as PIGS) and spreads with the German debt has never been so wide. We will know more about it in a week’s time.

China’s stellar performance this year can be explained by strong performance in the technology sector, supportive government policies and stimulus, but also from the difference in starting valuations, China having suffered in recent years more than the rest of the world.

Our summary recommendations

In our latest investment committee, we agreed that in the current euphoric stock market and ever decreasing yields environment, increasing our exposure to the much less volatile and predictable private markets makes more sense. In order to implement this view, we took the opportunity to approve 3 new funds from some of the biggest and most established firms in the evergreen private equity and private credit space.

Chart of the month

The Philadelphia Fed Regional Index is an indicator that measures the current conditions in the manufacturing sector in the district of Philadelphia, which is the third largest in the United States. It arises from a survey conducted by the Philadelphia Fed on the general health of the economy and businesses and is a good measure of changes in the prices that manufacturers pay for raw materials and supplies.

The Philadelphia Fed prices paid index increased 8 points to 66.8 in August 2025, its highest reading since May 2022. The implementation of tariffs on August 1st likely has something to do with the reading.

Source: Tradingeconomics.com

Disclosures

This document has been issued by Stork Capital, registered with the Swiss Association of Asset Managers, and licensed by FINMA.

Offering Documents. This material is provided at your request for informational purposes only and is not intended as an offer, a solicitation of an offer, to buy, sell or carry out any transaction on investment instruments or other specific product, it only contains selected information with regards to Stork Capital’s services. The analysis and information contained herein do not constitute a personal recommendation or consider the particular investment objectives, investment strategies, financial situation and needs of any specific recipient. Certain services and products are subject to legal restrictions and cannot be offered worldwide on an unrestricted basis and/or may not be eligible for sale to all investors. All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, however, Stork Capital cannot guarantee the accuracy of such content, ensure its completeness, or warrant that such information has not or will not change.

Prior to any investment, prospective investors should carefully read the latest offering documentation, including but not limited to the fund’s prospectus which contains inter alia a comprehensive disclosure of applicable risks. The relevant constitutional and offering documents are available free of charge at Stork Capital’s principal office.

Risk Information and Potential Loss. Financial advisers generally suggest a diversified portfolio of investments. The funds described herein do not represent a diversified investment by themselves. This material does not constitute investment advice and should not be used as the basis for any investment decision. This material does not purport to provide any legal, tax or accounting advice. Prospective investors should consult their financial and tax adviser before investing in order to determine whether an investment would be suitable for them.

Any investor or prospective investor should be aware of the risks inherent in trading activity, such as but not limited to currency risk, interest-rate risk, market risk, insolvency risk, and is aware that trading can be very speculative and may result in losses as well as profits. Therefore, an investor should only invest if he/she has the necessary financial resources to bear a complete loss of this investment.

Portfolio Allocations. This material contains information that pertains to past performance or is the basis for previously-made discretionary investment decisions. The value of investments may fall as well as rise and investors may not get back the amount they invested. Thus, past performance does not necessarily provide any guarantee of future results. Accordingly, this information should not be construed as a current recommendation, research or investment advice. It should not be assumed that any investment decisions shown will prove to be profitable, or that any investment decisions made in the future will be profitable or will equal the performance of investments discussed herein. Any mention of an investment decision is intended only to illustrate our investment approach and/or strategy, and is not indicative of the performance of our strategy as a whole. Any such illustration is not necessarily representative of other investment decisions.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the portfolio's investments. Future investments may or may not be profitable.

Intended Recipients. This material and any information contained therein shall only be for the personal use of the intended recipient and shall not be redistributed to any third party, unless Stork Capital or the source of the relevant market data gives their approval. This material is not directed to any person in any jurisdiction where (on the grounds of that person’s nationality, residence or otherwise) such documents are prohibited. In particular, neither this document nor any copy thereof may be sent, taken into or distributed in the United States or to any US person.

Disclaimer of Endorsement. References in these discussion materials to any specific manager, service provider, vendor, market, index, financial procedure, process, resources, or commercial services do not constitute nor imply its endorsement, recommendation, or favour by Stork Capital. Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Stork Capital to buy, sell, or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change, they should not be construed as investment advice. The website links provided are for your convenience only and are not an endorsement or recommendation by Stork Capital of any of these websites or the products or services offered. Stork Capital is not responsible for the accuracy and validity of the content of these websites.

Investment Risks. Risks vary by the type of investment. For example, investments that involve futures, equity swaps, and other derivatives, as well as non-investment grade securities, give rise to substantial risk and are not available to or suitable for all investors. We have described some of the risks associated with certain investments below and, in certain cases, earlier in this presentation. Additional information regarding risks may be available in the materials provided in connection with specific investments. You should not enter into a transaction or make an investment unless you understand the terms of the transaction or investment and the nature and extent of the associated risks. You should also be satisfied that the investment is appropriate for you in light of your circumstances and financial condition.

Alternative Investments. Private investment funds and hedge funds are subject to less regulation than other types of pooled vehicles. Alternative investments may involve a substantial degree of risk, including the risk of total loss of an investor’s capital and the use of leverage, and therefore may not be appropriate for all investors. Liquidity may be limited. Investors should review the Offering Memorandum, the Subscription Agreement and any other applicable disclosures for risks and potential conflicts of interest. Alternative Investments may be subject to less regulation than other types of pooled investment vehicles such as mutual funds. Alternative Investments may impose significant fees, including incentive fees that are based upon a percentage of the realized and unrealized gains and an individual’s net returns may differ significantly from actual returns. Such fees may offset all or a significant portion of such Alternative Investment’s trading profits. Alternative Investments may not be required to provide periodic pricing or valuation information. Investors may have limited rights with respect to their investments, including limited voting rights and participation in the management of such Alternative Investments.

Real Estate. Investments in real estate involve additional risks not typically associated with other asset classes, such as sensitivities to temporary or permanent reductions in property values for the geographic region(s) represented. Real estate investments (both through public and private markets) are also subject to changes in broader macroeconomic conditions, such as interest rates.

The sole place of jurisdiction for all disputes arising out of or in connection with this material and/or the present disclaimer and/or to the use of this material is Geneva, Switzerland, and it shall be exclusively governed by and construed in accordance with Swiss law.